Micron's 1-alpha process node offers impressive improvements in DRAM density and performance

Forward-looking: Memory technology has continuously improved over the concluding decade to come across the increasing demand for college bit density, functioning, and energy efficiency. Micron is touting new improvements made with traditional manufacturing methods on its latest retentiveness node, but the company volition eventually be forced to adopt EUV to proceed scaling its DRAM products.

Micron recently started manufacturing DRAM using its new 1α (i-blastoff) procedure and delivered the first volume shipment of the new chips to some of its largest customers. The new memory node supports densities from 8Gb to 16Gb, and is currently used to make DDR4 and LPDDR4 RAM, with plans to extend that across the company's entire production portfolio.

The announcement comes in the context of increasing need for memory chips and the need to meliorate manufacturing costs. Most of Micron's DRAM manufacturing has been using its 1Z nm technology since 2022, just the 1α process affords a 40 percent comeback in memory density along with a 15 percent drop in power consumption.

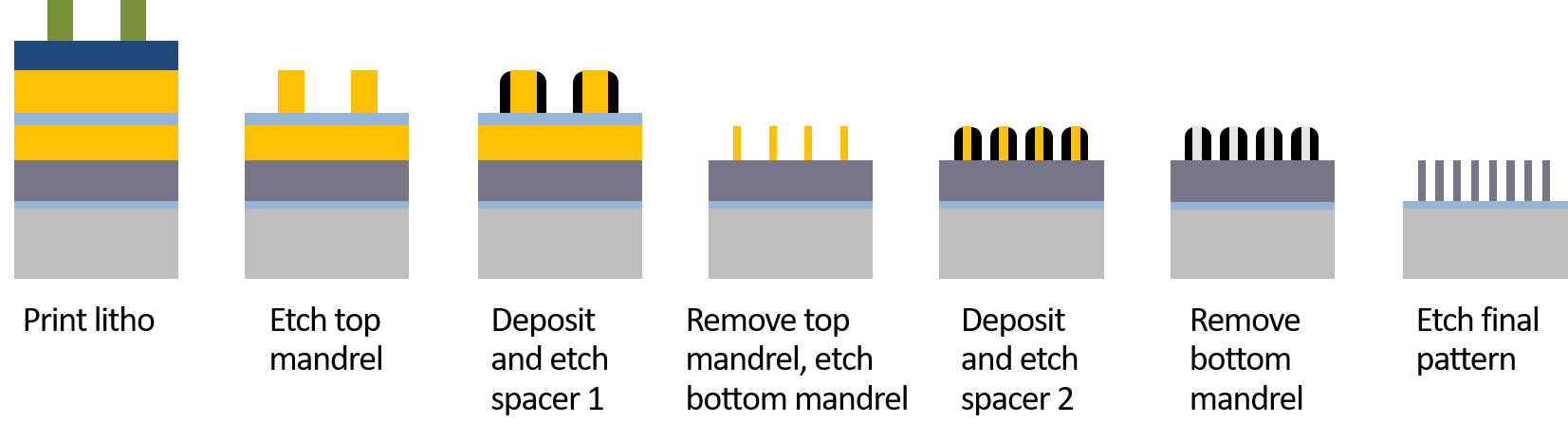

Around 10 percent of the performance boost was achieved by improvements in DRAM design such every bit aggressive shrinking of the bitline and discussion line pitches, too every bit better materials and more advanced tooling to eolith, selectively remove, or etch those materials onto the chips.

The company plans to finish integrating the new 1α process node beyond all of its DRAM products by the cease of the year -- an ambitious transition at a fourth dimension when parts of the supply concatenation are running tight. Earlier this month during an investor telephone call, Micron assured investors that it'southward monitoring for potential disruptions and that there is no cause for alert.

Of course, Micron's biggest trouble is that shortages of components are affecting companies like AMD, Nvidia, and Apple tree, which in turn leads to lower need for DDR4, LPDDR4X, LPDDR5, GDDR6, and GDDR6X. Still, Micron says its new 1α process node will lead to a subtract in DRAM manufacturing costs which in plow should atomic number 82 to better prices.

In a statement, Micron executive VP Sumit Sadana said the company's new 1α DRAM technology "will enable the industry's lowest-power mobile DRAM as well as bring the benefits of our DRAM portfolio to information center, client, consumer, industrial and automotive customers. [...] With our industry leadership in both DRAM and NAND engineering science, Micron is in an first-class position to leverage the growth in memory and storage, which are expected to be the fastest growing segments in the semiconductor industry over the next decade."

DRAM is a big chunk of Micron'south business, accounting for lxx percent of Micron's revenue over the last quarter ending on December 3, 2022. We're talking virtually $iv.06 billion on a gross margin of 31 percentage, which means Micron is doing well for the time existence.

The company does warn that scaling DRAM further will be a monumental task that can't yet be solved by adopting extreme ultraviolet lithography (EUV), but information technology does take a path for continued improvements over the side by side decade.

To that end, Micron is hard at piece of work on developing its 1β and 1𝛾 nodes using proven multi-patterning methods to achieve competitive DRAM designs in terms of scrap density, power consumption, performance, and cost. The visitor is considering EUV for its 1𝛿 node, but that is planned for 2024 or 2025, equally Micron explains it's not a primal enabler for scaling and is especially difficult to apply in increasingly complex DRAM designs like DDR5, GDDR6/6X.

In the meantime, Samsung is already using EUV for volume manufacturing of DDR4 and LPDDR5 chips, while SK Hynix is developing a new process node based on EUV. Time will tell if Micron's strategy is right, as EUV does incur boosted manufacturing costs that tend to first the improvements it brings.

Source: https://www.techspot.com/news/88430-micron-1-alpha-process-node-offers-impressive-improvements.html

Posted by: spearmanfixered56.blogspot.com

0 Response to "Micron's 1-alpha process node offers impressive improvements in DRAM density and performance"

Post a Comment